/04/13 · as far as forex slow stochastic goes, i like my setting at ,3,3 and my macd at ,22,9 here is the reason: what exactly are they mesuring? overbought/over sold on stoch and moving averages cross over with macd measureing divergence and momentum /08/18 · The modern or "Full Stochastics" oscillator combines elements of Lane’s "slow stochastics" and "fast stochastics" into three variables that control look back periods and extent of /09/16 · Stochastic Oscillator Settings for Forex Trading. Stochastic Oscillator Settings is 5, 3, 3 by default on MT4 platform. It seems that is the best settings for this indicator. However, some Forex traders like to try the faster and slower settings. The larger the numbers, the slower the indicator, and visa blogger.comted Reading Time: 4 mins

Pick The Right Settings On Your Stochastic Oscillator (SPY, AAL)

The Stochastics oscillatordeveloped by George Lane in the s, tracks the evolution of buying and selling pressure, identifying cycle turns that alternate power between bulls and bears. Understand that whatever you choose, the more experience you have best stochastic settings for forex the indicator will improve your recognition of reliable signals.

Short-term market players tend to choose low settings for all variables because it gives them earlier signals in the highly competitive intraday market environment. Long-term market timers tend to choose high settings for all variables because the highly smoothed output only reacts to major changes best stochastic settings for forex price action.

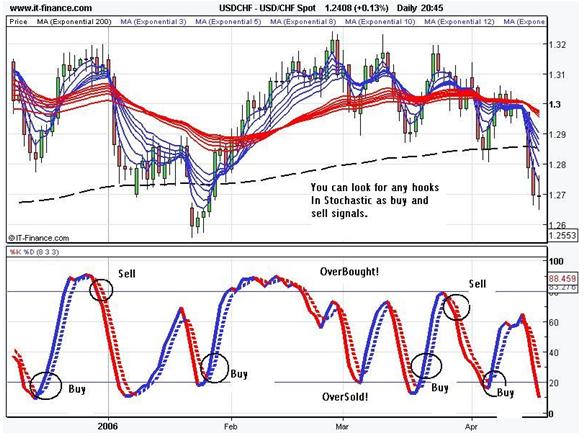

Cycle turns occur when the fast line crosses the slow line after reaching the overbought or oversold level. The responsive 5,3,3 setting flips buy and sell cycles frequently, often without the lines reaching overbought or oversold levels.

The mid-range 21,7,7 setting looks back at a longer period but keeps smoothing at relatively low levels, best stochastic settings for forex, yielding wider swings that generate fewer buy and sell signals.

The long-term 21,14,14 setting takes a giant step back, signaling cycle turns rarely and only near key market turning points. Shorter term variables elicit earlier signals with higher noise levels while longer term variables elicit later signals with lower noise levels, except at major market turns when time frames tend to line up, triggering identically-timed signals across major inputs. You can see this happen at the October low, where the blue rectangle highlights bullish crossovers on all three versions of the indicator.

These large cycle crossovers tell us that settings are less important at major turning points than our skill in filtering noise levels and reacting to new cycles. From a logistical standpoint, this often means closing out trend following positions and executing fading strategies that buy pullbacks or sell rallies. Stochastics don't have to reach extreme levels to evoke reliable signals, best stochastic settings for forex, especially when the price pattern shows natural barriers.

While the most profound turns are expected at overbought or oversold levels, crosses within the center of the panel can be trusted as long as notable support or resistance levels line up. This highlights the importance of reading the price pattern at the same time you interpret the indicator. American Airlines Group AAL rallied above the day EMA after a volatile decline and settled at new support 1forcing the indicator to turn higher before reaching best stochastic settings for forex oversold level.

It broke out above a 2-month trendline and pulled back 2triggering a bullish crossover at the midpoint of the panel, best stochastic settings for forex. The subsequent rally reversed at 44, yielding a pullback that finds support at the day EMA 3triggering a third bullish turn above the oversold line.

Many traders fail to tap into the power of Stochastics because they are confused about getting the right settings for their market strategies. These helpful tips will remedy that fear and help unlock more potential. Technical Analysis Basic Education. Beginner Trading Strategies. Your Money. Personal Finance. Your Practice. Popular Courses. Trading Strategies Beginner Trading Strategies. Take the Next Step to Invest.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Technical Analysis Basic Education The Top Technical Indicators for Commodity Investing. Technical Analysis Basic Education MACD and Stochastic: A Double-Cross Strategy. Technical Analysis Basic Education Tackling Technicals for Beginners.

Beginner Trading Strategies Gauging Entry and Exit Signals With Range Bars. Technical Analysis Basic Education How to Interpret the Volume Zone Oscillator. Partner Links. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history.

Worden Stochastics Definition and Example The Worden Stochastics indicator plots the percentile rank of the latest closing price best stochastic settings for forex to other closing values in the lookback period.

Relative Vigor Index RVI Definition The Relative Vigor Index RVI measures the strength of a trend by comparing a closing price to the daily range. It is similar to the stochastic oscillator in how it generates trade signals. What Is a Golden Cross?

A golden cross is a candlestick pattern that is a bullish signal in which a relatively short-term moving average crosses above a long-term moving average. Relative Strength Index RSI The Relative Strength Index RSI is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions.

Best stochastic settings for forex Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Best Stochastic Indicator Settings - (How To Profit Using Stochastics Trading Strategy In 2021)

, time: 17:11Best Stochastic Oscillator Settings You Can Follow

/09/16 · Stochastic Oscillator Settings for Forex Trading. Stochastic Oscillator Settings is 5, 3, 3 by default on MT4 platform. It seems that is the best settings for this indicator. However, some Forex traders like to try the faster and slower settings. The larger the numbers, the slower the indicator, and visa blogger.comted Reading Time: 4 mins /04/13 · as far as forex slow stochastic goes, i like my setting at ,3,3 and my macd at ,22,9 here is the reason: what exactly are they mesuring? overbought/over sold on stoch and moving averages cross over with macd measureing divergence and momentum /08/18 · The modern or "Full Stochastics" oscillator combines elements of Lane’s "slow stochastics" and "fast stochastics" into three variables that control look back periods and extent of

No comments:

Post a Comment