06/08/ · The point is that there are many options that you can profit from the EMA crossover forex strategy, and the great thing is that you only really need to use two simple technical indicators. You don’t need to stick to the five and period settings because you may find that you get the same good results from using a ten and period EMA crossover strategy instead Crossover strategies are a staple in the trading world, even in forex trading. This is probably due to the fact that crossover strategies are very simple and easy to follow. Perhaps most traders would get acquainted to crossover strategies in one way or another, especially newbies 18/06/ · Confirmed Crossover Forex Trading Strategy is a very basic and popularly used trading strategy. It is a pretty fast crossover strategy that excels in catching a trend pretty early. As you could notice, the SMA strategy is able to capture big trends from start to finish

EMA Crossover Strategy - Advanced Forex Strategies

The TRIX method starts with a simple moving average line of closing prices. This is the first data series in the TRIX calculation. Next, we crossover forex strategy to calculate the simple moving average of the first series at the chosen period. This forms the second data series. Finally, we calculate the exponential moving average EMA of the second series. This results in the third smoothed series, known as DX. After calculating the third series the next step is to calculate its first derivative, or rate of change.

From this we obtain the TRIX value:. The signal line is the exponential moving average of the TRIX at the chosen signal period.

When plotted together on the same chart, crossover forex strategy, the intersection of the TRIX line and the signal line provide us with information about trend and price momentum. The TRIX is a rate of change indicator. That means its value can be either positive or negative. The TRIX value and the signal swing up and down around the zero line in response to the underlying trend. A histogram is an additional output that is sometimes useful and this plots the difference between the TRIX line and the signal line.

The histogram shows places where there is a deviation in the TRIX and signal line. This highlights areas in which the trend is changing, either slowing down or speeding up. TRIX is similar to the MACD. Both identify times when the market is potentially overbought and oversold, crossover forex strategy. Both TRIX and MACD create crossover events that can be useful for trading decisions. Like most indicators, crossover forex strategy, the TRIX has a period.

The period of the TRIX determines the size of the moving average filters for both the crossover forex strategy and TRIX line. A longer TRIX period results in a smoother, slower changing line that is less sensitive to noise.

A shorter TRIX period will respond faster but is more sensitive to false reporting. By convention, the signal period of the TRIX should be shorter than the TRIX period. This is because the signal line is crossover forex strategy the TRIX, which is already a smoothed series. Knowing how to calculate the TRIX is not necessary to use it. There are several TRIX indicators available that will do all of the calculations for you and plot the output on the chart.

The value of the TRIX lies in its ability to detect changes in trend direction. The triple layer of averaging means that it is less sensitive to random price fluctuations. Therefore, TRIX is less prone to false reversal signals than are some other systems. The main use of the TRIX system is in analyzing crossover events. These indicate places where the trend has reversed or might be about to reverse.

Most TRIX trading strategies use this information for entry and exit timing. A TRIX crossover happens when the signal line crosses the TRIX line.

A bullish crossover happens when the faster TRIX line crosses up through the slower signal line. A bearish crossover is the reverse. It happens when the TRIX line crosses down through the signal line.

These crossover forex strategy are marked on Figure 1. To analyze the chart at a chosen timeframe, crossover forex strategy, the TRIX is set with an appropriate period. A crossover forex strategy point is a TRIX period of 12 and a signal period of 8.

Test at various settings to make sure the crossovers are detecting the historical reversals without too many false positives. As an additional confirmation, it is helpful to check crossover forex strategy divergence between the price and the TRIX line. Because of the averaging, the chances are that when a strong TRIX crossover takes place it is signaling a change in trend rather than simple market noise or a brief pullback.

The highest and lowest TRIX outputs happen when a trend is accelerating. This often happens just before a reversal, crossover forex strategy.

The crossover of the zero line does not necessarily have any significance because it usually happens well after the crossover of the TRIX and signal.

Like all other indicators, the TRIX is susceptible to false reports also known as false positives. In the TRIX system, these occur usually where the output lines cross or touch briefly but then reverse again. These are inflection points Crossover forex strategy 2. False positives will increase when using a shorter TRIX period and decrease with a longer period, crossover forex strategy.

A longer period will produce a longer lag between the times the trend changes and the time the TRIX crossover happens.

Using the rate of change of the TRIX line helps to filter out inflections, crossover forex strategy. After analyzing a particular chart, you will be able to determine a threshold percentage where false positives are occurring. This ebook is a must read for anyone using a grid trading strategy or who's planning to do so.

Grid trading is a powerful trading methodology but it's full of traps for the unwary. This new edition includes brand new exclusive material and case studies with real examples.

Start here Strategies Technical Learning Downloads. Cart Login Join. Home Strategies. TRIX or the triple exponential moving average is a trend analysis system that has been around since the early 80s. You can use it to analyze trend momentum and reversals — TRIX is deployed in various swing trading, scalping, crossover forex strategy, and day trading strategies. This article describes a basic TRIX crossover strategy.

TRIX strategy © forexop. Figure 1: TRIX crossover strategy © forexop. BEST SELLER. Forex Scalping Explained: Strategies, Risks and Implementation Scalping is a type of day trading where the aim is to make small profits on a frequent basis. Fading the Fakeout — How to Trade Against False Breakouts A fading strategy bets against any move that takes the price out of a normal range. Another way of putting Why Day Trading Needs to be Boring Does it feel like a white-knuckle ride whenever you put on a trade?

If the answer is yes, something SMA and EMA Crossover: Moving Average Trading Strategies Perhaps one of the simplest trading strategies of all is that of the moving average crossover. How to Make the Most of Forex Order Types Orders are often seen as nothing more than a gateway to the real business of trading.

Yet the range Why Lowering Your Stress Leads to Better Trading Trading is tiring and stressful. It requires a lot of concentration and precise decision making. No Comments. Leave a Reply Cancel reply. Leave this field empty. Contact Us Timeline FAQ Privacy Policy Terms of Crossover forex strategy Home.

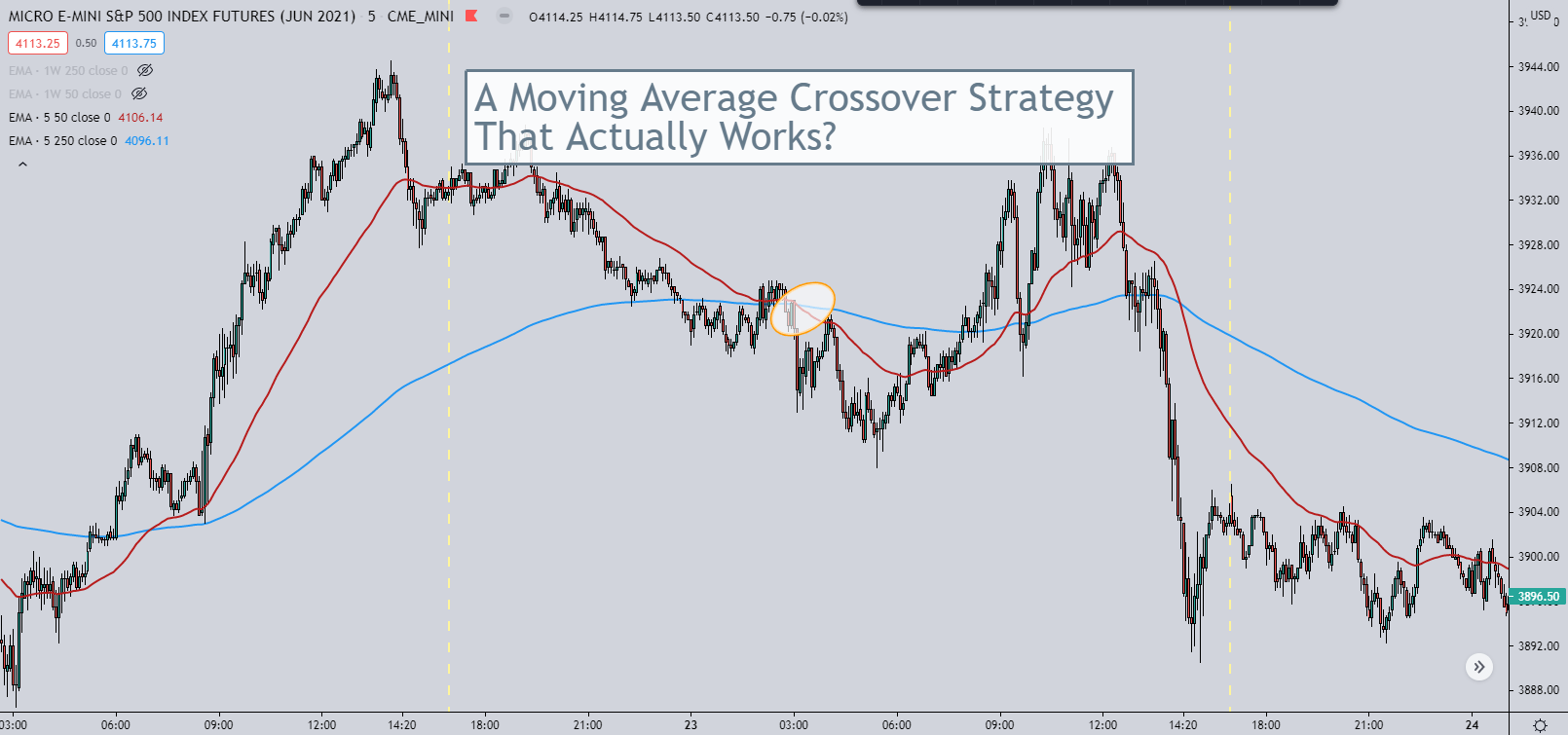

20/50 Moving Average Strategy That Works (With A Twist)

, time: 10:33Confirmed Crossover Forex Trading Strategy

23/08/ · The three moving average crossover strategy is an approach to trading that uses 3 exponential moving averages of various lengths. All moving averages are lagging indicators however when used correctly, can help frame the market for a blogger.comted Reading Time: 7 mins 18/06/ · Confirmed Crossover Forex Trading Strategy is a very basic and popularly used trading strategy. It is a pretty fast crossover strategy that excels in catching a trend pretty early. As you could notice, the SMA strategy is able to capture big trends from start to finish Crossover strategies are a staple in the trading world, even in forex trading. This is probably due to the fact that crossover strategies are very simple and easy to follow. Perhaps most traders would get acquainted to crossover strategies in one way or another, especially newbies

No comments:

Post a Comment