Leverage is a feature or offering by the Forex trading brokers to their customers which allows you to trade with borrowed money. In simple words, by using leverage you can trade large amounts of money by using very little of your own money and borrowing the rest from the blogger.comted Reading Time: 8 mins 13/05/ · What Is Leverage in Trading? Leverage involves using borrowed capital in order to facilitate an investment, resulting in the potential returns being magnified. Forex and CFD leverage allows both retail and professional traders to access larger position sizes with a smaller initial blogger.com: Roberto Rivero 27/05/ · Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. In other words, leverage is a borrowed capital to increase the potential returns. The Forex leverage size usually exceeds the invested capital for several times

What is leverage in Forex trading? The Ultimate Guide | Liteforex

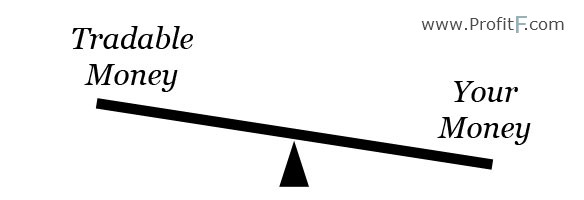

Forex Leverage is using borrowed money to open a trade in the Market. Usually the borrowed fund is used from the Broker you are working with. Thanks to Leverage, traders can use a higher capital to increase the chances of profit. However fromESMA European Securities and Markets Authority stabilized the max leverage for each Market. The Leverage is an important component of CFD Trading.

Of course, leveraging the capital can bring good results, but also can make you loose the initial budget quite easily. Every Broker Forex and CFD Trading provides a Leverage for the clients. Every trader should check the leverage level before opening an account. Most of the people may ask?

To understand better the concept, we have to introduce the concept of Margin Level. Margin is closely related to leverage. In order to use leverage, definition of leverage in forex trading, the broker will demand a percentage of the investment to be deposited as a guarantee. This deposited amount depends on the budget you are going to invest, as well as on the leverage you will use. It would be great to leverage only the profit, but in reality includes risks as well.

The original budget can be lost quickly if you use a high leverage. Save my name, email, and website in this browser for the next time I comment. All Rights Reserved. What is Forex Leverage? Contents 1 What is Forex Leverage? Please follow and like us:.

Share Article:. September 23, Social Trading vs Copy Trading. September 23, What is Online Trading and how it works.

Leave a Definition of leverage in forex trading Cancel reply Save my name, email, and website in this browser for the next time I comment.

This IS WHY Most BEGINNERS Lose Their ACCOUNTS (What Is Leverage?)

, time: 24:32What is Leverage in Forex? Forex Leverage Explained

Leverage is a feature or offering by the Forex trading brokers to their customers which allows you to trade with borrowed money. In simple words, by using leverage you can trade large amounts of money by using very little of your own money and borrowing the rest from the blogger.comted Reading Time: 8 mins 27/05/ · Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. In other words, leverage is a borrowed capital to increase the potential returns. The Forex leverage size usually exceeds the invested capital for several times Definition of:Leveragein Forex Trading. The ratio of the value of a transaction vs the funds on margin

No comments:

Post a Comment