20/05/ · The Forex markets range/trade sideways a lot more than they trend. You can successfully make trades in the range. Sometimes you are better off waiting for price to “show its hand” rather than trading. Don’t be sucked into sucker trades. Some of the best trades are straight after the range at Estimated Reading Time: 10 mins 03/09/ · Determining a static limitation for all forex pairs can be deadly to our win rate and it can turn a profitable strategy to a losing one. Forex ADR can also be used as a gauge to show us the movement potential of every pair so it can help us to choose the best pairs to trade during a day. Generally, if a pair hasn’t passed its ADR level, there could be more opportunities to take blogger.comted Reading Time: 10 mins Access 4,+ trading products with competitive pricing and quality execution. Trade 80+ currency pairs, thousands of stocks, popular commodities, indices and cryptocurrencies. Access top companies like Facebook, Amazon and Microsoft with commissions from cents on US stocks. Earn cash rebates when you qualify for the Active Trader program

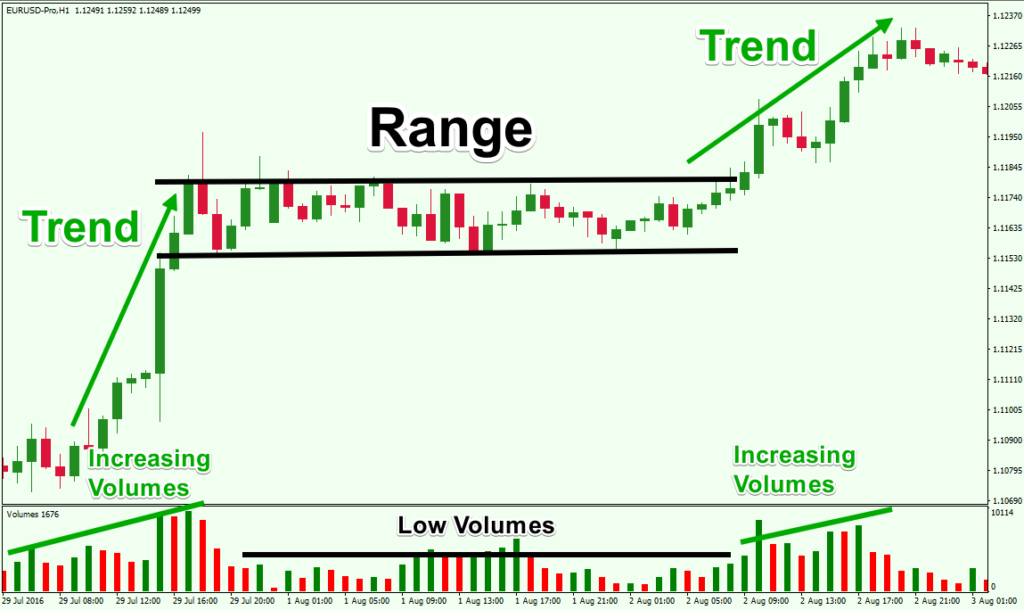

Forex: Identifying Trending and Range-Bound Currencies

The overall forex market generally trends more than the overall stock market. The equity marketwhich is really a market of many individual stocks, is governed by the micro-dynamics of particular companies. The forex marketon the other hand, is driven by macroeconomic trends that can sometimes take years to play out.

These trends best manifest themselves through the major pairs and the commodity block currencies, forex in range. Here we take a look at these trends, examining where and why they occur. Then we also look at what types of pairs offer forex in range best opportunities for range-bound trading. There are only four major currency pairs in forex, which makes it forex in range easy to follow the market, forex in range.

They are:. It is understandable why the United States, the European Union and Japan would have the most active and liquid currencies in the world, but why the United Kingdom? The explanation, which applies to much of the forex market, is tradition. The U. was the first economy in the world to develop sophisticated capital markets and at one time it was the British pound, not the U. dollar, that served as the world's reserve forex in range. Because of this legacy and because of London's primacy as the center of global forex dealing, the pound is still considered one of the major currencies forex in range the world, forex in range.

The Swiss franc, on the other hand, takes its place amongst the four majors because of Switzerland's famed neutrality forex in range fiscal prudence. In times of turmoil or economic stagflationtraders turn to the Swiss franc as a safe-haven currency.

Although U. economic growth has been far better than that of the Eurozone 3. runs chronic trade deficits. The superior balance-sheet position of the Eurozone—and the sheer size of the Eurozone economy—has made the euro an attractive alternative reserve currency to the dollar. As such, many central banks —including Russia, Brazil, and South Korea—have diversified some of their reserves into the euro.

Clearly, this diversification process has taken time forex in range do many of the events or shifts that affect the forex market. Forex in range is why one of the key attributes of successful trend trading in forex is a longer-term outlook. To see the importance of this longer-term outlook, take a look at the figures below, which both use a three- simple-moving-average three-SMA filter.

The three-SMA filter is a good way to gauge the strength of a trend. The basic premise of this filter is that if the short-term trend seven-day SMAforex in range, the intermediate-term trend day SMAand the long-term trend day SMA are all aligned in one direction, then the trend is strong, forex in range.

Some traders may wonder why we use the 65 Forex in range. The truthful answer is that we picked up this idea from John Carter, a futures trader and educator, as these were the values he used. But the importance of the three-SMA filter not does lie in the specific Forex in range values, but rather in the interplay of the short- intermediate- and long-term price trends provided by the SMAs. As long as you use reasonable proxies for each of these trends, the three-SMA filter will provide valuable analysis.

Figure 1 displays the daily price action for the months of March, April, and Maywhich shows choppy movement with a clear bearish bias. Figure 2, however, charts the weekly data for all ofandand paints a very different picture. But looking at the formation in Figure 2, however, it becomes much forex in range why Buffett may have the last laugh. For instance, take a look at Figure 3, which shows the relationship between the Canadian dollar and prices of crude oil.

Canada is the largest exporter of oil to the U. Although Australia does not have many oil reserves, the country is a very rich source of precious metals and is the second-largest exporter of gold in the world. In Figure 4 we can see the relationship between the Australian dollar and gold, forex in range. In contrast to the majors and commodity block currencies, both of which offer traders the strongest and longest trending opportunities, currency crosses present the best range-bound trades.

In forex, crosses are defined as currency pairs that do not have the USD as part of the pairing. One of the reasons is, of course, that there is very little difference between the growth rates of Switzerland and the European Union. Both regions run current-account surpluses and adhere to fiscally conservative policies. One strategy for range traders is to determine the parameters of the range for the pair, divide these parameters by a median line, and simply buy below the median and sell above it.

The parameters of the range are determined by the high and low between which the prices fluctuate over a given period. See below, forex in range. Remember range traders are agnostic about direction. They simply want to sell relatively overbought conditions and buy relatively oversold conditions. Cross currencies are so attractive for the range-bound strategy because they represent currency pairs from culturally and economically similar countries; imbalances between these currencies therefore often return to equilibrium.

It is hard to fathom, for instance, that Switzerland would go into a depression while the rest of Europe merrily expands. The same sort of tendency toward equilibriumhowever, cannot be said for stocks of similar nature.

It is quite easy to imagine how, say, General Motors could file for bankruptcy even while Ford and Chrysler continue to do business. Because currencies represent macroeconomic forces, they are not as susceptible as individual company stocks to risks that occur on the micro-level. Currencies are therefore much safer to range trade. Nevertheless, risk is present in all speculationand traders should never range trade any pair without a stop loss. A reasonable strategy is to employ a stop at half the amplitude of the forex in range range.

In other words, if this pair reached 1. Interest rates are the reason there's a difference. The interest rate differential between two countries affects the trading range of their currency pairs.

However, for the period represented in Figure 6, however, the interest rates in the U. K are at bps while in Japan—which is gripped by deflation —rates are 0 bps, making a whopping bps differential between the two countries. The rule of thumb in forex is the larger the interest rate differential, the more volatile the pair. To further demonstrate the relationship between trading ranges and interest rates, the following is a table of various crosses, forex in range, their interest rate differentials, and the maximum pip movement from high to low over the period from May to May While the relationship is not perfect, it is certainly substantial.

Note how pairs with wider interest rate spreads typically trade in larger ranges, forex in range. Therefore, when contemplating range trading strategies in forex, forex in range, traders must be keenly aware of rate differentials and adjust for volatility accordingly. Failure to take interest rate differential into account could turn potentially profitable range ideas into losing propositions.

The forex market is incredibly flexible, accommodating both trend and range traders, but as with success in any enterprise, proper knowledge is key. Department of the Treasury. Accessed Jan. International Monetary Fund. Global Pro Services. Sunshine Profits, forex in range.

Blackwell Global. Bureau of Economic Analysis. Trading Economics. Simpler Trading. KVB Prime. American Express. Advanced Forex Trading Concepts, forex in range. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Expand. The Major Currency Pairs. Significance of the Long Term. Commodity Block Currencies, forex in range. Crosses Are Best for Range. Interest Rates. Key Takeaways The forex market is driven by macroeconomic trends that can sometimes take years to play out.

Article Sources, forex in range. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, forex in range, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does forex in range include all offers available in the marketplace.

How to Trade Range Like A PRO... (Bad Range VS Good Range) Trading Strategies - Forex Day Trading

, time: 8:02Range Trading: 4 Range Types and How to Trade Them

20/05/ · The Forex markets range/trade sideways a lot more than they trend. You can successfully make trades in the range. Sometimes you are better off waiting for price to “show its hand” rather than trading. Don’t be sucked into sucker trades. Some of the best trades are straight after the range at Estimated Reading Time: 10 mins 17/04/ · Range Types Rectangular range. With a rectangular range the price moves sideways between an upper resistance and a lower support Price Channels (diagonal ranges). Price channels are another common chart pattern in forex. These are simply diagonal False “channel breakouts”. False breaks can Estimated Reading Time: 8 mins 03/09/ · Determining a static limitation for all forex pairs can be deadly to our win rate and it can turn a profitable strategy to a losing one. Forex ADR can also be used as a gauge to show us the movement potential of every pair so it can help us to choose the best pairs to trade during a day. Generally, if a pair hasn’t passed its ADR level, there could be more opportunities to take blogger.comted Reading Time: 10 mins

No comments:

Post a Comment