14/05/ · The usual best trading time is the 8 a.m. to noon overlap of the New York and London exchanges. These two trading centers account for more than 50% of all forex trades. On the flip side, from 5 p.m. to 6 p.m., trading mostly happens on the Singapore and Sydney exchanges, where there is far less volume than during the London/New York window 09/06/ · Forex Trading Statistics. Forex markets had a daily turnover of $ trillion dollars in , up from $ trillion in The total value of the forex industry increased from $ quadrillion dollars in to $ in Forex is the only financial market in the world to operate 24 hours a day. The forex market is comprised of Estimated Reading Time: 9 mins Volume will cluster around trading ranges - If price spends a long time trading around a narrow range from prices, volume will be higher in that area and lower outside the area. The logic behind this is a simple application of auction market theory: acceptance of prices have led market participants to freely transact with each other, absorbing each other's resting liquidity

Forex Market Hours - Live Forex Market Clock & Session Times

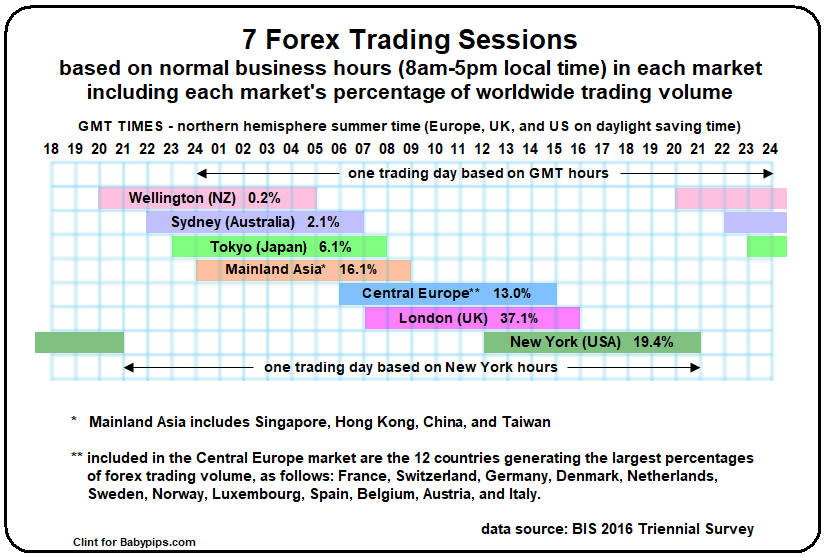

The optimal time to trade the forex foreign exchange market is when it's at its most active levels. That's when trading spreads the differences between bid prices and ask prices tend to narrow. In those situations, less money goes to the market makers facilitating currency trades, which leaves more money for the traders to pocket personally. The four major forex exchanges are located in London, New York, Sydney, and Tokyo. Forex traders need to commit their hours to memory, with particular attention paid to the hours when two exchanges overlap.

When more than one exchange is open at the same time, this increases trading volume and adds volatility—the extent and rate at which equity or currency prices change. The volatility can benefit forex traders. This may seem paradoxical. After all, investors generally fear market volatility. In the forex game, however, forex trading volumeby time and area volatility translates to greater payoff opportunities.

The forex is fully electronic and open somewhere in the world between 5 p. Sunday and 5 p, forex trading volumeby time and area. Friday Eastern Standard Time EST. Each exchange has unique trading hours from Monday through Friday. From the average trader's perspective, the four most important time windows all EST are as follows:. While each exchange functions independently, they all trade the same currencies. So, when two exchanges are open, forex trading volumeby time and area, the number of traders actively buying and selling a given currency greatly increases.

The bids and asks in one forex market exchange immediately impact bids and asks on all other open exchanges. That reduces market spreads and increases volatility, including in the following windows:. The New York exchange is especially important for foreign investors. Its trades involve the U. Movements of the dollar can have a strong ripple effect around the world. The usual best trading time is the 8 a.

to noon overlap of the New York and London exchanges. On the flip side, from 5 p. There can be exceptions, and the expected trading volume is based on the assumption that no major news will come to light.

Political or military crises that develop during otherwise slow trading hours could potentially spike volatility and trading volume. Certain economic data that can move the market has a steady release schedule. It includes jobless figures, Consumer Price Index CPItrade deficits, and consumer confidence and consumer consumption.

Knowing when this news is set for release can help time when to trade. Forex traders should forex trading volumeby time and area with caution, because currency trades often involve high leverage rates of 1, to 1.

While this ratio forex trading volumeby time and area tantalizing profit opportunities, it comes with an investor's risk of losing an entire investment in a single trade.

The chief takeaway is that new forex investors should open accounts with firms that offer demo platforms, which let them make mock forex trades and tally imaginary gains and losses. Once investors learn the ropes and become seasoned enough, then they can confidently begin making real forex trades. Like many other investments, while there is money to be made, there is also plenty of opportunity to lose.

So, make it a point to educate yourself. The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. Forex trading is simply the trading of different currencies in order to make money on changes in currencies' values relative to one another. Most of this trading occurs via electronic platforms or over the phone rather than on exchanges, forex trading volumeby time and area. Each trade involves a pair of currencies.

Your ability to make money trading forex depends on the proportion of trades you win and how big your profits are on individual trades. A typical trader trading two hours a day during peak hours can make roughly trades in a month.

To start trading forexyou'll just need to make an initial deposit with a brokerage. It's also smart to read up and practice making trades before you start risking your money in forex trading. You can try demo trading on many electronic trading platforms before committing your own money.

Corporate Finance Institute. New York University Stern School of Business. Kathy Lien. Census Bureau. Accessed May 14, Trading Forex Trading.

Table of Contents Expand. Table of Contents. The 4 Major Forex Exchanges. Worldwide Forex Markets Hours. High-Volume Trading Hours Can Be Risky. Frequently Asked Questions FAQs. By John Russell Full Bio LinkedIn John Russell is an expert in domestic and foreign markets and forex trading. He has a background in management consulting, forex trading volumeby time and area, database administration, and website planning. Today, he is the owner and lead developer of development agency JSWeb Solutions, which provides custom web design and web hosting for small businesses and professionals.

Learn about our editorial policies. Reviewed by Julius Mansa. Article Reviewed May 31, Julius Mansa is a finance, operations, and business analysis professional with forex trading volumeby time and area 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Learn about our Financial Review Board. Article Sources.

LIQUIDITY IN FOREX - HOW BANKS TRADE - watch this to understand [SMART MONEY CONCEPTS] - mentfx ep.4

, time: 45:04Where Is the Central Location of the Forex Market?

09/06/ · Forex Trading Statistics. Forex markets had a daily turnover of $ trillion dollars in , up from $ trillion in The total value of the forex industry increased from $ quadrillion dollars in to $ in Forex is the only financial market in the world to operate 24 hours a day. The forex market is comprised of Estimated Reading Time: 9 mins The FX market is open 24 hours a day from Monday (or Sunday) to Friday (or Saturday) - as one part of the world goes to sleep, another wakes up. That's why we talk about Forex market hours and Forex trading sessions - to describe where and when the different Forex trading sessions are open to trading 14/05/ · The usual best trading time is the 8 a.m. to noon overlap of the New York and London exchanges. These two trading centers account for more than 50% of all forex trades. On the flip side, from 5 p.m. to 6 p.m., trading mostly happens on the Singapore and Sydney exchanges, where there is far less volume than during the London/New York window

No comments:

Post a Comment