The Moving Average Convergence Divergence or MACD, is one of the most widely known and used indicators in technical analysis. It is used both to indicate the market trend and the momentum of a movement. In summary, the MACD is an oscillator-type indicator that shows the distance between a fast exponential moving average (EMA) and a slow exponential Estimated Reading Time: 6 mins MACD was devised by Gerald Appel and became popular immediately because it creates a momentum indicator out of moving averages, which are by their nature trend-following. With the MACD, you get two of the three technical features you need, missing only volatility. MACD is Moving average convergence divergence (MACD) is among the technical indicators with a huge popularity when it comes to trading. The MACD is a preferred method by traders worldwide, because it is simple to understand and also flexible. It is usually used both as a trend-following indicator and as one gauging momentum

Moving Average Convergence Divergence (MACD) - Technical Analysis

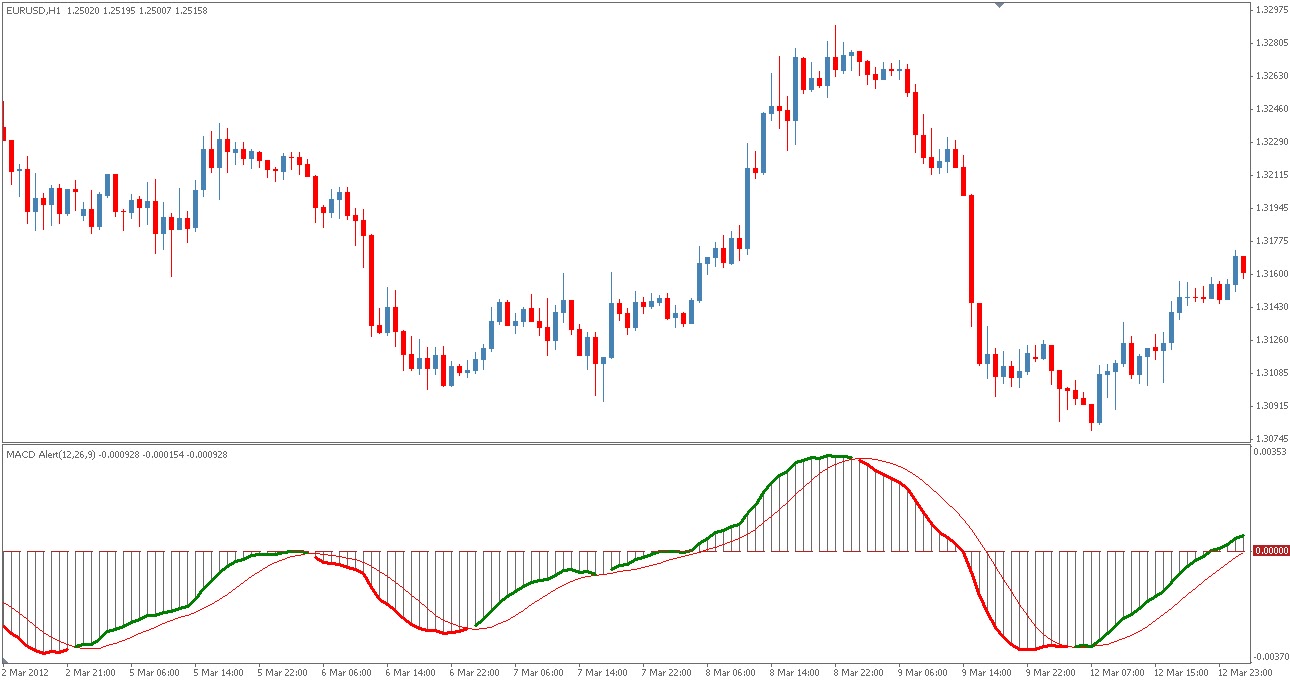

The Moving Average Convergence Divergence MACD is probably one of the most popular and well-known oscillator indicators in any market. It is essentially a two-part tool that traders can utilize. The first of these parts of the MACD is probably the one used most often, the MACD line and the signal line.

General strategies related to the MACD is that you should consider taking a buy when the MACD line crosses above the signal line and sell when the MACD crosses below the signal line. Additionally, some strategies suggest more conservative entries based on when the MACD crosses the middle line 0-line. The second part of the MACD, and perhaps the one that confuses many new traders, is the histogram with the 0-line.

However, the real strength of this is the ability to see divergences. The downsides to the MACD indicator is that it is very notorious for causing whipsaws in traders.

Whipsaws can be avoided by not using the MACD as your sole indicator of trade signals. The MACD is an excellent tool to help confirm your trades in a trending market, moving average convergence divergence forex it is not suitable for a ranging market. If you are a new trader, the MACD is a fantastic tool to help you train and learn about how indicators work. Spend some time watching markets live on smaller time frames and look at how the MACD works and moves with that market.

You will notice things you like i. I would caution against using the MACD in your trading. The MACD is an old indicator, and it is most useful as a tool for analysis on daily timeframes or weekly time frames. Because it is so well known and used so much by new traders, it is used against new traders. It is one of those indicators use to entice new traders into using — like bait. Just like moving averages, the MACD has several strategies that involve a crossover. Again, the MACD is an indicator that is entirely lagging in nature.

It is showing what has already happened, not moving average convergence divergence forex will happen. Well explained, thanks. Ill now look to composite index moving average convergence divergence forex i cannot see the tool in Trading view, moving average convergence divergence forex.

Save my name, email, and website in this browser for the next time I comment. About Us Advertise With Us Contact Us. Forex Academy. Home Forex Technical Analysis Forex Indicators MACD — Moving Average Convergence Divergence. RELATED ARTICLES MORE FROM AUTHOR. The Absolute Best Forex Indicators and How to Combine Them. Forex Robots: Are they Money Making Machines? Differences Between Price Action and Forex Indicators.

LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! Popular Articles. Forex Chart Patterns Might Be an Illusion 4 September, How Important are Chart Patterns in Forex? Chart Patterns: The Head And Shoulders Pattern 16 January, Academy is a free news and research website, moving average convergence divergence forex, offering educational information to those who are interested in Forex trading.

EVEN MORE NEWS. Understanding the Economics of Cryptocurrencies 13 June, Trading Reversals Using Bullish Reversal Candlestick Patterns 12 June, Using Bollinger Bands to Time the Rectangle Pattern 11 June, moving average convergence divergence forex, POPULAR CATEGORY Forex Market Analysis Forex Brokers Forex Service Review Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL RIGHTS RESERVED.

Mastering MACD indicator for Forex Beginners (Basics)

, time: 23:44Trading divergence and convergence in Forex

The Moving Average Convergence Divergence or MACD, is one of the most widely known and used indicators in technical analysis. It is used both to indicate the market trend and the momentum of a movement. In summary, the MACD is an oscillator-type indicator that shows the distance between a fast exponential moving average (EMA) and a slow exponential Estimated Reading Time: 6 mins MACD was devised by Gerald Appel and became popular immediately because it creates a momentum indicator out of moving averages, which are by their nature trend-following. With the MACD, you get two of the three technical features you need, missing only volatility. MACD is Moving average convergence divergence (MACD) is among the technical indicators with a huge popularity when it comes to trading. The MACD is a preferred method by traders worldwide, because it is simple to understand and also flexible. It is usually used both as a trend-following indicator and as one gauging momentum

No comments:

Post a Comment