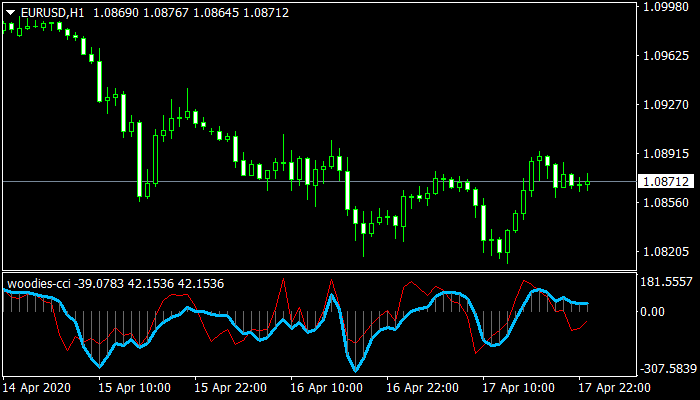

CCI Indicator Strategy to Win Trades || With Combined 2 Indicators || % Working Iq Options We make videos using this software bot which aims to make i The chart above (Fig. ) depicts the Commodity Channel Index bearish divergence for the EURUSD H1. Price is shown to form a higher high, while the CCI indicator lower high. Commodity Channel Index trading strategies for scalpers. To start off our Commodity Channel Index trading strategy for scalpers, we 27/09/ · Buy signal: Buy at the market when the TMA Slope is green and the CCI is below Use a protective stop loss of 10 pips and take profit once the TMA Slope turns back to gray. Sell signal: Sell at the market when the TMA Slope is red and the CCI is above Use a protective stop loss of 10 pips and take profit once the TMA Slope turns back to blogger.comted Reading Time: 5 mins

Commodity Channel Index Forex Indicator | CCI Explained

by TradingStrategyGuides Last updated Jun 28, All StrategiesForex StrategiesIndicator Strategies 3 comments. In this article, you will also learn about the CCI indicator and why it is useful in your trading. Long-term profitability demands different types of trading skills that our CCI trading strategy PDF will reveal to you next. You can also read Trend Line Drawing with Fractals. One of the fundamental trading principles that our team at Trading Strategy Guides religiously follows winning forex with the cci indicator 100 off to trade in the direction of the dominant energy of the market.

This is really important, so make sure you commit this to memory. We also have training on how to use currency strength for trading success. The CCI indicator was created by Donald Lambert and was initially used to identify cycles in the commodity market.

However, winning forex with the cci indicator 100 off, it tends to perform the same in the stock market or the Forex currency market and even the cryptocurrency market for that matter. As you may guess by now, the only indicator you need to spot new market cycles is the CCI indicator. The CCI indicator strategy was really designed to find cyclical trends in the market winning forex with the cci indicator 100 off to be used as a bearish or bullish filter.

You have to keep in mind that technical indicators are just mathematical equations. This means that we can use the crossing of the zero line to gauge a shift in the market sentiment.

You need to use them in combination with your price action reading skills. The reason why the CCI formula uses a constant of 0. But, of course, that the CCI values are dependent of other variables such as the look-back period. This is something to keep in mind when you sent the CCI indicator settings. Like any technical indicator, the CCI indicator also has some limitations. Day trading requires active trade management. So, due to the high risk associated with day trading, you need to implement trading practices that are suitable for that type of trading style.

However, here at Trading Strategy Guides, we have developed a day trading CCI strategy using only 5 conditions:. If you would have taken the first signal the first time the CCI indicator reached the level, you would have lost money. Hopefully, you can see now why we wait for two consecutive oversold readings to buy. In other words, winning forex with the cci indicator 100 off, we need the price to make lower lows while the CCI indicator has to do higher lows.

In an uptrend, we would look for higher highs in prices and lower highs reading on the CCI indicator. When the CCI crosses above the level we know that the market is starting to shift to the upside. A good trading tip on how to use the CCI indicator is in conjunction with chart analysis, which is the central theme of this CCI trading strategy PDF.

Here is an approach to currencies by Warren Buffett. In other words, the dominant market energy is to the upside. Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this entry method.

Also, read trading discipline which is also a most important skill for successful trading. As a leading indicator, the Commodity Channel indicator can provide us with excellent great trade signals. Waiting for a pullback in price is a more defensive trading approach. We either buy after we have seen the market pulling back over the last candles or we buy straight away if we have sharp corrections.

If the retrace was weak, it means the dominant energy of the market remains up. The CCI indicator strategy reflects winning forex with the cci indicator 100 off well what is happening behind the scene where the actual buying and selling pressure takes place. This brings us to the next important thing that we need to establish for the CCI trading strategy, which is where to place our protective stop loss.

Simply place your protective stop loss below the most recent swing low. Last but not least, we also need to define where we take profits when trading with the Commodity Channel Index indicator.

However, since the market will only occasionally give us such big trading opportunities we need to have a backup plan. As soon as the CCI indicator turns below the zero level, we want to exit our trade. The first sign that the rally is running out of steam is when the CCI indicator crosses below the zero line. Use the same rules for a SELL trade — but in reverse. In the figure below, you can see an actual SELL trade example. The overarching principles of the CCI strategy can be applied to your own trading strategy as well.

All markets move in cycles, so we recommend using the CCI indicator in combination with higher time frames as this will yield better trading performance according to our backtesting results. Please leave a comment below if you have any questions about this CCI trading strategy PDF!

Please Share this Trading Strategy Below and keep it for your own personal use! Thanks Traders! We specialize in teaching traders of all skill levels how to trade stocks, options, forex, winning forex with the cci indicator 100 off, cryptocurrencies, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Table of Contents hide.

Or, sharp Corrections are bought at the closing price, winning forex with the cci indicator 100 off. Whichever happens first. Author at Trading Strategy Guides Website. Anuj gupta says:. May 7, at pm. Ronald V says:. February 23, at pm. TradingStrategyGuides says:. February 24, at am. Search Our Site Search for:. Free Offers! Categories Advanced Training All Strategies Chart Pattern Strategies 55 Cryptocurrency Strategies 48 Forex Basics 44 Forex Strategies Indicator Strategies 70 Indicators 44 Most Popular 19 Options Trading Strategies 30 Price Action Strategies 36 Stock Trading Strategies 63 Trading Programming 5 Trading Psychology 11 Trading Survival Skills Close dialog.

Session expired Please log in again.

Forex trading Strategy 100% winning trades!! WIN every trade you take!!!

, time: 17:511 Minute Forex Scalping Strategy with CCI and Slope Indicator

Expired Winning FOREX with the CCI Indicator. Coupon Waali April 9, Udemy % Free Coupon Udemy Save Saved Removed 0 Saved Removed 0 The chart above (Fig. ) depicts the Commodity Channel Index bearish divergence for the EURUSD H1. Price is shown to form a higher high, while the CCI indicator lower high. Commodity Channel Index trading strategies for scalpers. To start off our Commodity Channel Index trading strategy for scalpers, we 23/05/ · The CCI is an oscillator class indicator that prints a line graph operating between a scale of + & The CCI can print outside of these ranges; in strong markets I’ve seen the CCI print values over + When the user attaches the CCI to their chart that need to input in the period value, the default is 14

No comments:

Post a Comment